Growing Demand for K-Content

Beyond K-Dramas: Netflix's Strategic Expansion into Korean Reality ShowsNetflix is doubling down on Korean unscripted shows! This past July, the streaming platform announced it will release a new Korean unscripted show every month until the first quarter of 2025. Thanks to this expansive strategy, the streaming service will have more than doubled its offerings from 2022, growing to 10 shows by the end of the year. What’s driving the streaming giant to expand this specific type of content?

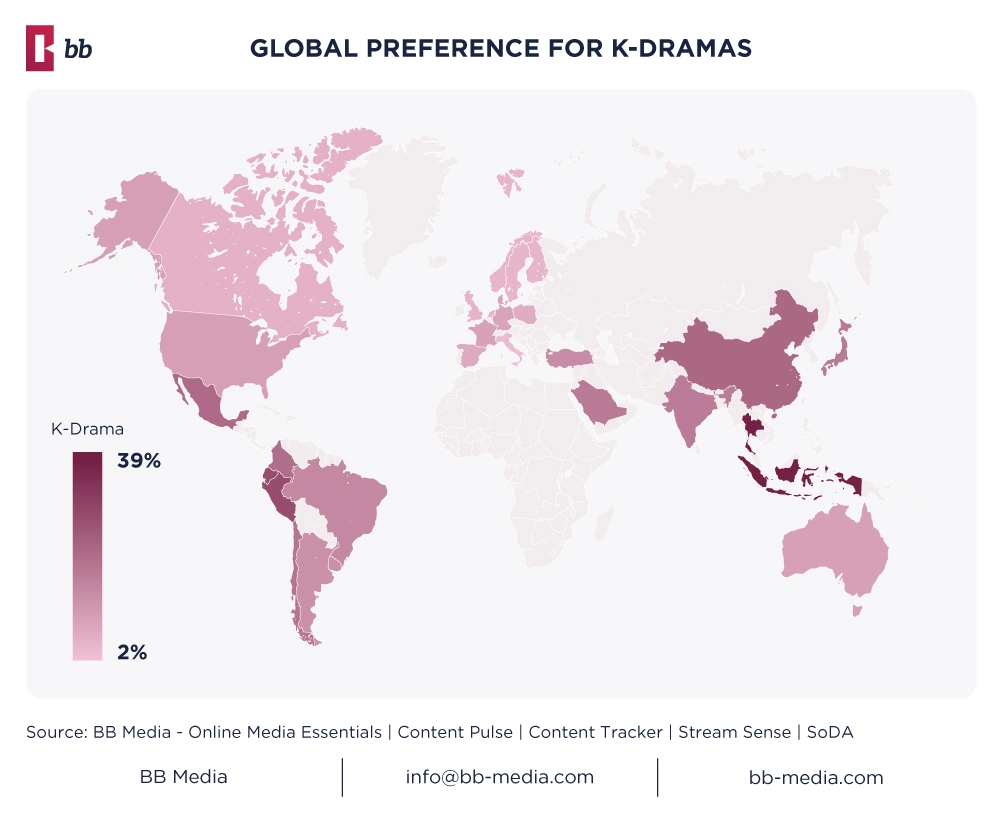

In recent years, interest in Korean content, especially K-Dramas, has been growing, transcending South Korean borders and captivating audiences worldwide. Outside of APAC, LATAM has emerged as a significant market, with 17% of users showing a liking for this genre. Among the countries in the region, Ecuador (28%), Peru (27%), and Mexico (21%) appeared as the most interested in this type of content. The primary audience for K-Dramas predominantly consists of younger generations, a trend that remains consistent worldwide. In APAC, UCAN, and EMEA, this preference is evenly split between Gen Z and Millennials. However, in LATAM, Gen Z exhibits a slightly higher interest in this genre compared to Millennials.

Given that LATAM is the second region most inclined towards K-Dramas, it’s no surprise that when users were asked about the origin of their favorite content, Korean productions ranked 5th overall. This preference was even stronger among Gen Z, who ranked Korean content as their 3rd favorite. Within the main markets in the region, Gen Z in Colombia showed the highest preference, with 41% choosing Korean content as their favorite, closely followed by Gen Z in Mexico (39%) and Brazil (35%). But a key question arises: Do Korean shows drive subscriptions for Netflix in LATAM? Let’s dive into some insights.

‘Squid Game’ (2021) was one of Netflix’s most successful ventures into Korean audiovisual productions, quickly becoming a global phenomenon. For LATAM users, this Netflix original proved to be a powerful subscription driver, ranking among the top 10 shows cited as influencing their decision to subscribe. In Brazil, Netflix users specifically mentioned both “K-Dramas” as a genre and ‘Love in the Moonlight’ (2016), a Period K-Drama, as content that motivated them to join the streaming service. Even among non-users, K-Dramas appear to be a significant draw, ranking 5th among the top 10 most mentioned drivers for potential subscriptions.

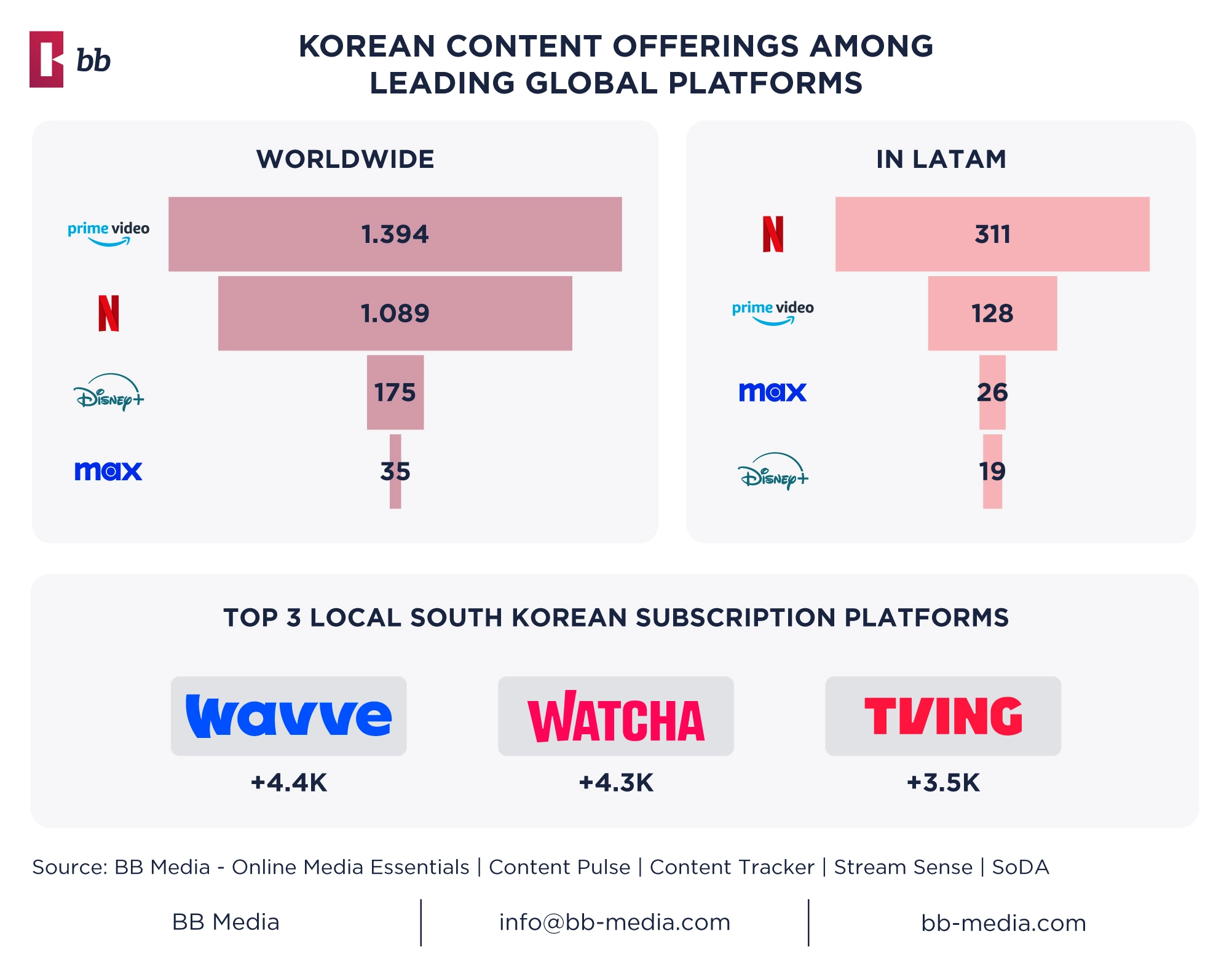

Globally, three South Korean subscription platforms lead in Korean content offerings: Wavve and Watcha, each with over 4,000 titles, and Tving, with over 3,500 titles. Excluding local platforms, Amazon Prime Video currently holds the top position among global subscription streaming platforms, though Netflix is close behind, falling short by just 305 titles. In LATAM, however, Netflix takes the lead clearly catering to the strong preference among the Latin American audience for both K-Dramas and Korean content in general. Furthermore, Netflix holds a distinct advantage globally in terms of original productions. While Netflix currently boasts 151 original titles produced in Korea in its catalog, Amazon Prime Video only has two: ‘The Handmaiden’ (2016) and ‘Burning’ (2018). As of now, no other leading platform has announced plans to release or produce additional Korean content.

What’s more, compared to Amazon Prime Video, Disney+ and Max, Netflix stands out globally, with its Korean titles being the most streamed worldwide in 2023 and 2024. Of the top 10 most streamed Korean shows, 9 are Netflix’s original productions. What’s interesting is that while 5 of the 10 most-streamed Korean productions are traditional K-Dramas, where Drama, Comedy, Romance, and Family are the primary genres, 4 of the remaining titles break away from this typical mold. ‘The Glory’(2022), ‘Alchemy of Souls’(2022), ‘Squid Game’(2021), and ‘Sweet Home’(2020)—all Netflix original productions—move beyond romance-centered storylines, exploring more mature and darker narratives through genres such as Horror, Suspense, and Mystery. This trend highlights the evolution of K-Dramas and suggests that the involvement of major streaming companies, which cater to a global audience, may be a driving force behind the recent transformations in Korean content production.

Nonetheless, not all of the most streamed Korean productions are K-Dramas. Notably, the 3rd most streamed title is ‘Physical: 100’ (2023), a Netflix original unscripted Reality TV show where 100 contestants in peak physical condition compete in a series of grueling challenges. Given the success of this unscripted original —and considering its significantly lower production costs compared to major scripted series like Squid Game— it’s reasonable that Netflix is looking to expand its unscripted slate. Currently, of the entire global offering of Korean content, 96% are scripted shows, while only 4% are unscripted, noting the significant imbalance between the two categories. However, with production costs being far lower than scripted shows, there’s a growing trend of unscripted content making a comeback.

As the global appetite for K-Content continues to surge, Netflix’s commitment to expand its unscripted offerings signals a strategic move to diversify and meet the evolving tastes of its audience. By balancing its successful slate of K-Dramas with other innovative unscripted shows like Physical: 100, Netflix is not only capitalizing on the current demand for K-Contents but also helping to shape South Korean productions to keep appealing to a global audience.

Explore the Netflix overview on BB Media’s Streaming Services Directory. Interested in South Korean platforms? Access free data on Wavve, Watcha and Tving!

Looking for more insights into APAC markets and trends? Contact BB Media at info@bb-media.com.

Sources

BB Media | Online Media Essentials | Content Pulse | Content Tracker | Stream Sense | SoDA

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.