Audiovisual Piracy in LATAM and Spain

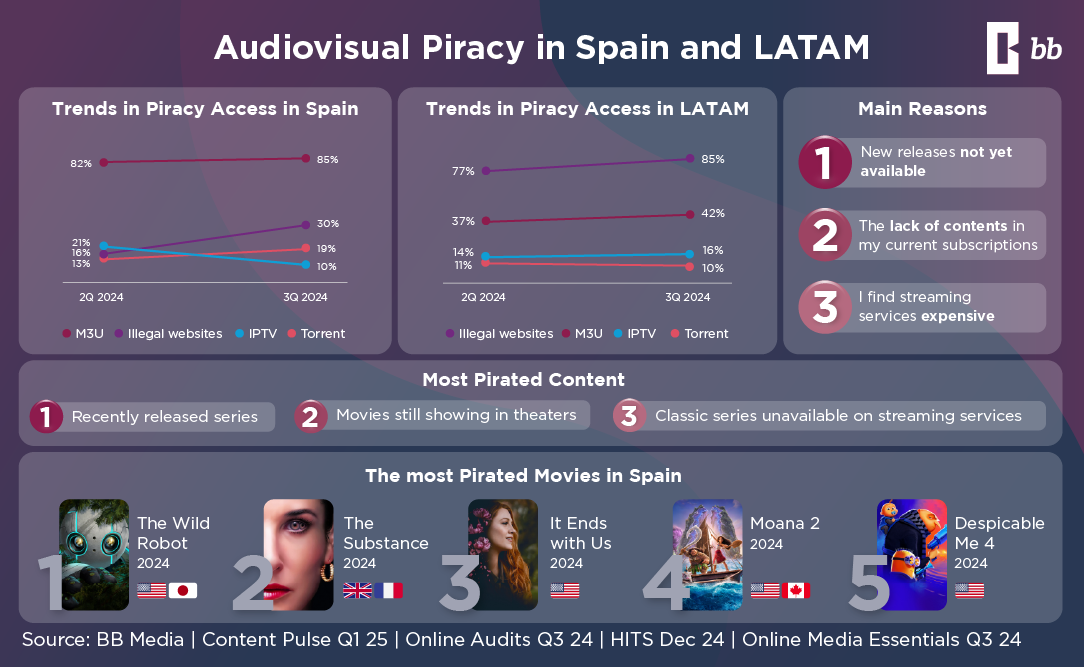

Trends and ChallengesAudiovisual Piracy continues to impact the entertainment industry, affecting both content creators and cultural industries. As digital access grows, piracy methods evolve, posing new challenges. According to BB Media, audiovisual piracy trends in Latin America increased significantly in 2023, and during 2024 it maintained a penetration of over 40% among internet-connected households—equivalent to nearly 24 million homes.

Audiovisual Piracy Trends

Within the Spanish-speaking countries, piracy is not limited to Latin America. In Spain, it remains a significant issue, with 30% of households, or over 5 million homes, using illegal services to access content. The methods of access differ between regions. In Latin America, the most common approach is through illegal streaming websites, which offer a vast selection of movies, series, and live TV channels. In Spain, piracy is more reliant on apps and M3U playlists, which users download from various sources to stream content illegally.

Why Do Users Resort to Audiovisual Piracy?

One of the main reasons people turn to piracy is the lack of availability of specific titles on the streaming services they pay for. On average, Spanish households subscribe to 2.36 platforms, while in Latin America, the number is 2.26. Even with multiple subscriptions, users often struggle to find the content they want.

Another key factor is limited access to new movies and series releases. Many users resort to piracy because they cannot find new premiere seasons or recent films on legal platforms shortly after their theatrical debut.

Sports content is another major driver of piracy. Football is the most illegally streamed sport, with 82% of pirated sports content being football matches, followed by combat sports (23%) and motorsports (22%). The most frequently pirated events include major leagues and first-division tournaments, both at the international and national levels.

Most Pirated Content in 2024

Analyzing the most offered pirated content in the Spanish-speaking market, recent movie releases dominate illegal platforms.

- The Wild Robot (2024) ranks first in both Latam and Spain, despite its availability on 8 platforms in LATAM and 3 streaming services in Spain. It appears on 75 illegal sites.

- The Substance (2024) follows, accessible on Prime Video, Apple TV, and MUBI in LATAM and Filmin in Spain, yet pirated across 68 platforms.

For series, the trend is similar:

- The Penguin (2024) (Max original) is the most pirated series in Latam.

- Highway (2024) leads in Spain.

- Other popular pirated shows include High Potential (Disney+) and Landman (Paramount+ & Claro Video).

Combatting Audiovisual Piracy – A Global Effort

Governments, tech companies and copyright organizations continue to take action against piracy. Measures such as blocking illegal websites, removing unauthorized content and launching awareness campaigns aim to reduce its impact. However, many users remain unaware of how piracy affects both the entertainment industry and their own data security.

Reducing piracy requires a multi-layered approach. Strengthening legal enforcement, expanding content availability, and offering affordable streaming options are crucial to discouraging users from resorting to illegal alternatives. While piracy persists, understanding audiovisual piracy trends helps the industry refine its strategies to protect content and provide users with better legal alternatives.

Sources

BB Media | Online Audits

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Our Latest Insights

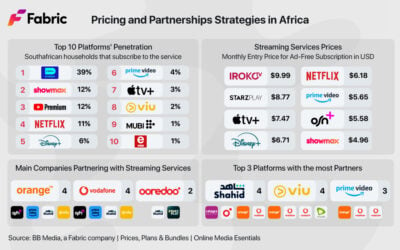

Streaming Pricing Strategies and Partnerships in Africa

Unlocking Opportunities in the African Streaming Market Streaming pricing strategies are key to succeeding in Africa’s dynamic entertainment market. Implementing flexible pricing strategies, adaptable subscription models and forming strategic partnerships can...

Global Streaming Insights – March 2025 Updates

Major streaming services continue to expand and evolve. From new platform launches to strategic partnerships, here are the key updates from March 2025.

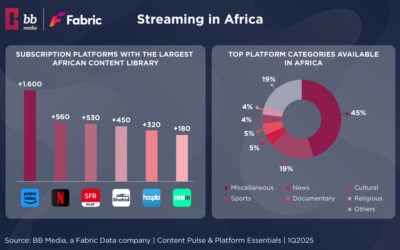

African Content on Streaming

Streaming platforms are expanding their African content offerings, with Nigeria, South Africa, and Egypt leading the way. From co-productions to genre trends, explore how African storytelling is making its mark globally.

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.