From Family Fun to All-Audience Appeal

A New Era for Disney+ After Its Merger with Star+The streaming world within LATAM is transforming quickly. After the recent rebranding and merging of previously existing services HBO Max and Discovery+ last year, two more notable platforms have decided to emulate this strategy. On June 26th, Disney+ and Star+ have unified under the improved, more complete platform, Disney+. According to data collected in Q1 of this year, approximately 29% of households with internet access across LATAM were consumers of Disney+. Additionally, 23% of households with internet were also viewing content from Star+, making these platforms 2 of the Top 5 most consumed OTTs across the region.

This transition will grant Disney+ subscribers’ access to the complete The Walt Disney Company catalog, alongside ESPN, 20th Century Studio, Searchlight, and FX content previously featured on Star+. To appeal to users, the updated platform will continue utilizing Star+ branding for Star+ originals that have already been released and are widely recognized. Additionally, ESPN will remain a separate entity within the platform, retaining its unique logo available for user selection as the method to access sports content.

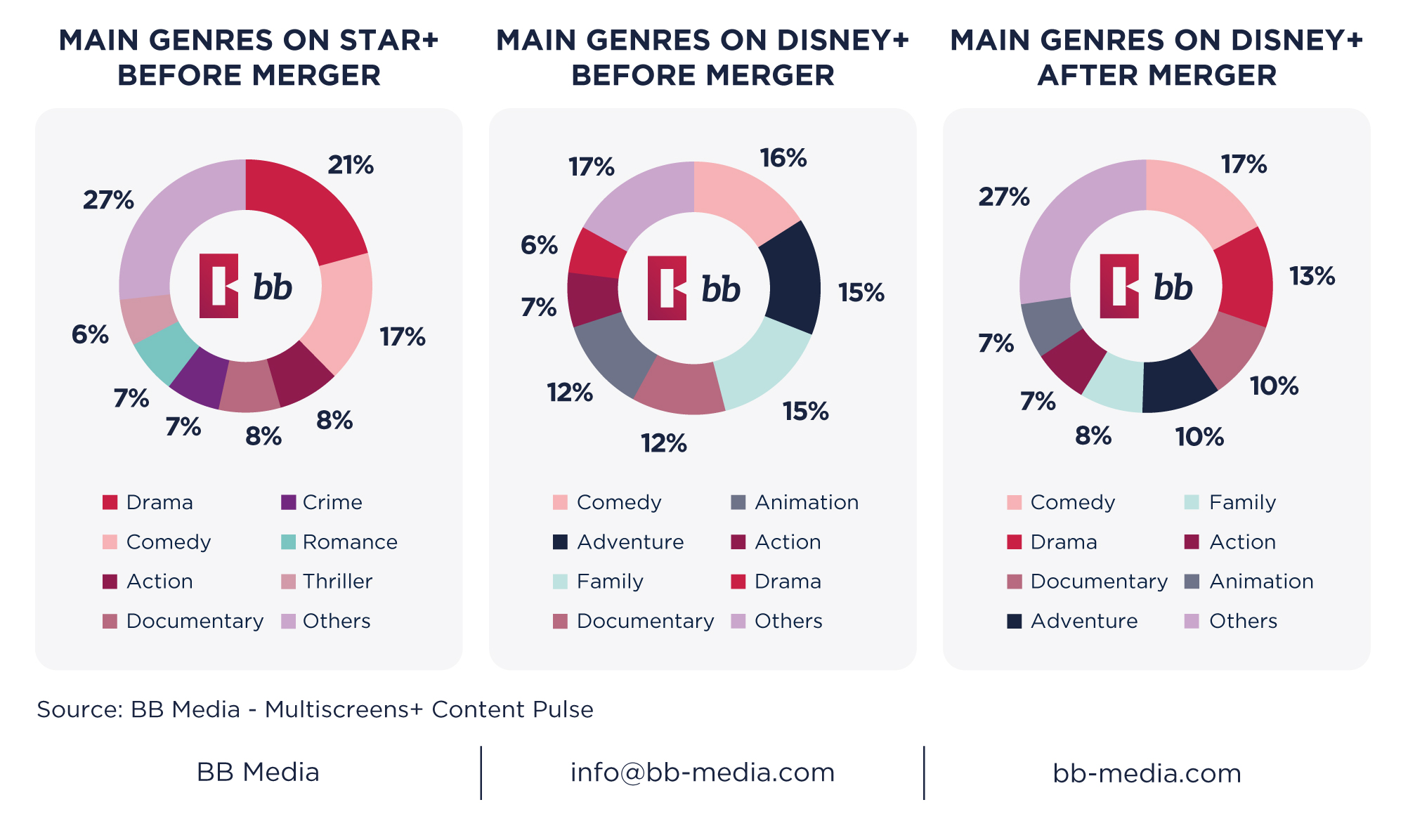

This combination will deliver a significantly more diverse collection of content to users, as Disney+ previously had been geared towards more light-hearted, family-oriented movies and series. Before this transition, the top genres accessible on the platform included Comedy, Adventure, Family, Documentary, and Animation. Meanwhile, the predominant genres on Star+ consisted of Drama, Comedy, Action, Documentary, and Crime. This disparity in content is evident in that Drama significantly outnumbered any other genre on Star+ yet was not featured in any of the top 5 genres on the former Disney+ catalog. Furthermore, 15% of Disney+ available titles were classified as Family content, appearing as the 3rd most frequent genre, which did not appear even among the top 15 genres on Star+.

Since the transition, the amount of content classified as Drama has increased drastically, becoming the second most featured genre provided by Disney+. While Adventure, Family, Action, and Animation have retained their positions among the top 7 genres, their offerings have been surpassed by the Documentary genre which now sits as the 3rd most featured genre among the improved platforms. In comparison, with the unification of HBO Max and Discovery+, the genre distribution of content on the platform maintained its top three genres (Drama, Comedy, and Documentary), with only minor changes in the rest of the content share. Following the merger, Reality TV, a strong content category within Discovery+, grew dramatically within the Max catalog, now accounting for 7% of the platform’s content. For context, before the unification, Reality TV was not present in any of the top 20 genres on the platform.

Across LATAM, before the merger, both Star+ and Disney+ offered a similar number of titles (1,500 and 1,703 each, respectively); with only a minor difference in total, skewed towards Disney+. Both Star+ and Disney+ held a large collection of recent releases with 67% of Star+ titles and 48% of Disney+ titles being released in 2022 or 2023. This small difference may reflect the varying launch dates between each platform within LATAM, as Disney+ was introduced nearly a year before Star+, in 2020.

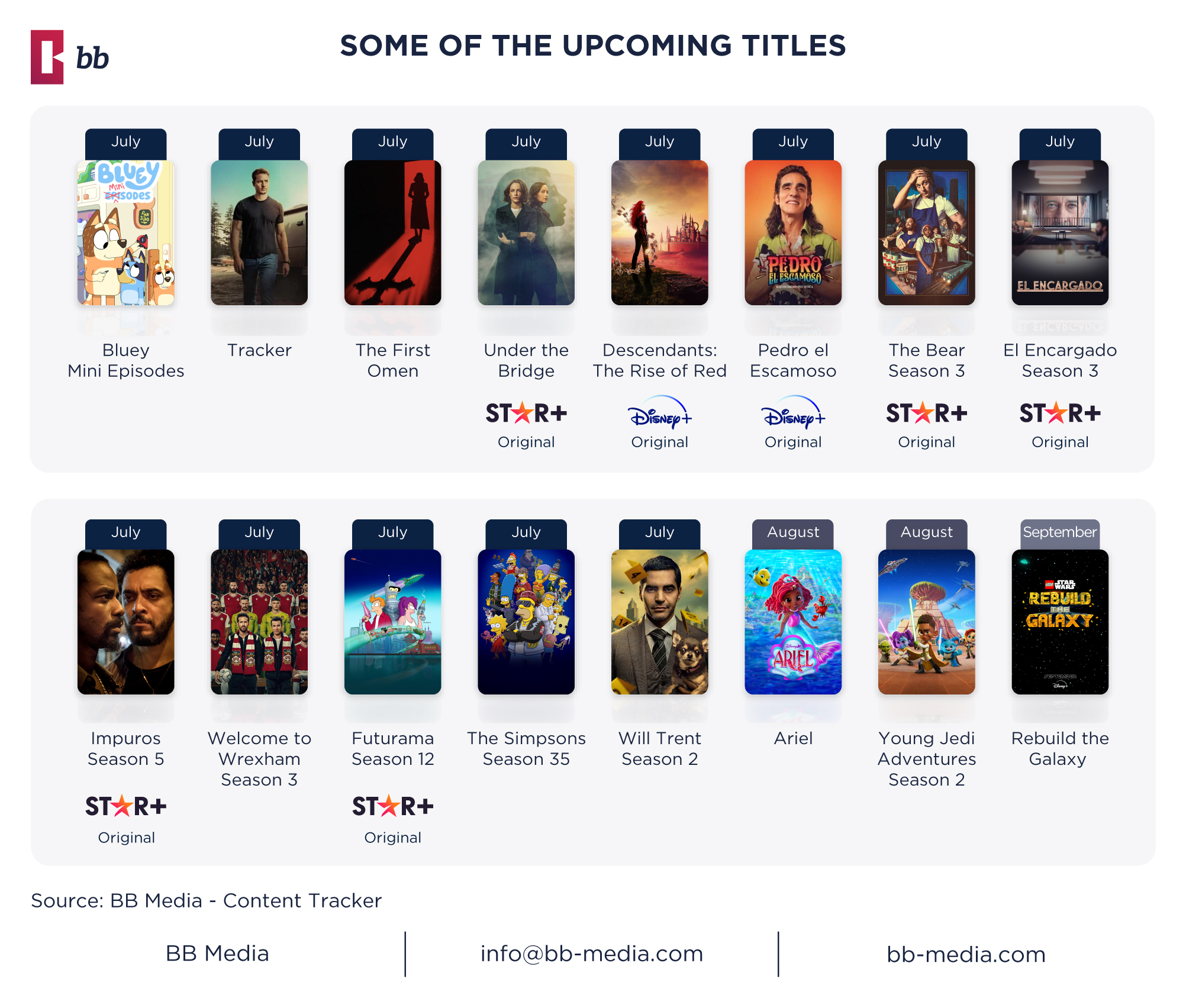

The upgraded platform is anticipated to add at least 16 more titles in the coming year. Of the 16 titles announced so far, 50% are new releases, such as ‘Descendants: The Rise of Red’ (2024), ‘LEGO Star Wars: Rebuild the Galaxy’ (2024) and ‘The First Omen’ (2024). The remaining 50% correspond to the launch of additional seasons of both Star+ and Disney+ series. Furthermore, 7 of the 16 titles are platform’s originals, including some of the most successful series from Star+, such as ‘The Bear’ (2022) and ‘El Encargado’ (2022). Most of the titles that are announced to be added will be Dramas, followed by Animation, Adventure, Action, and Comedy titles.

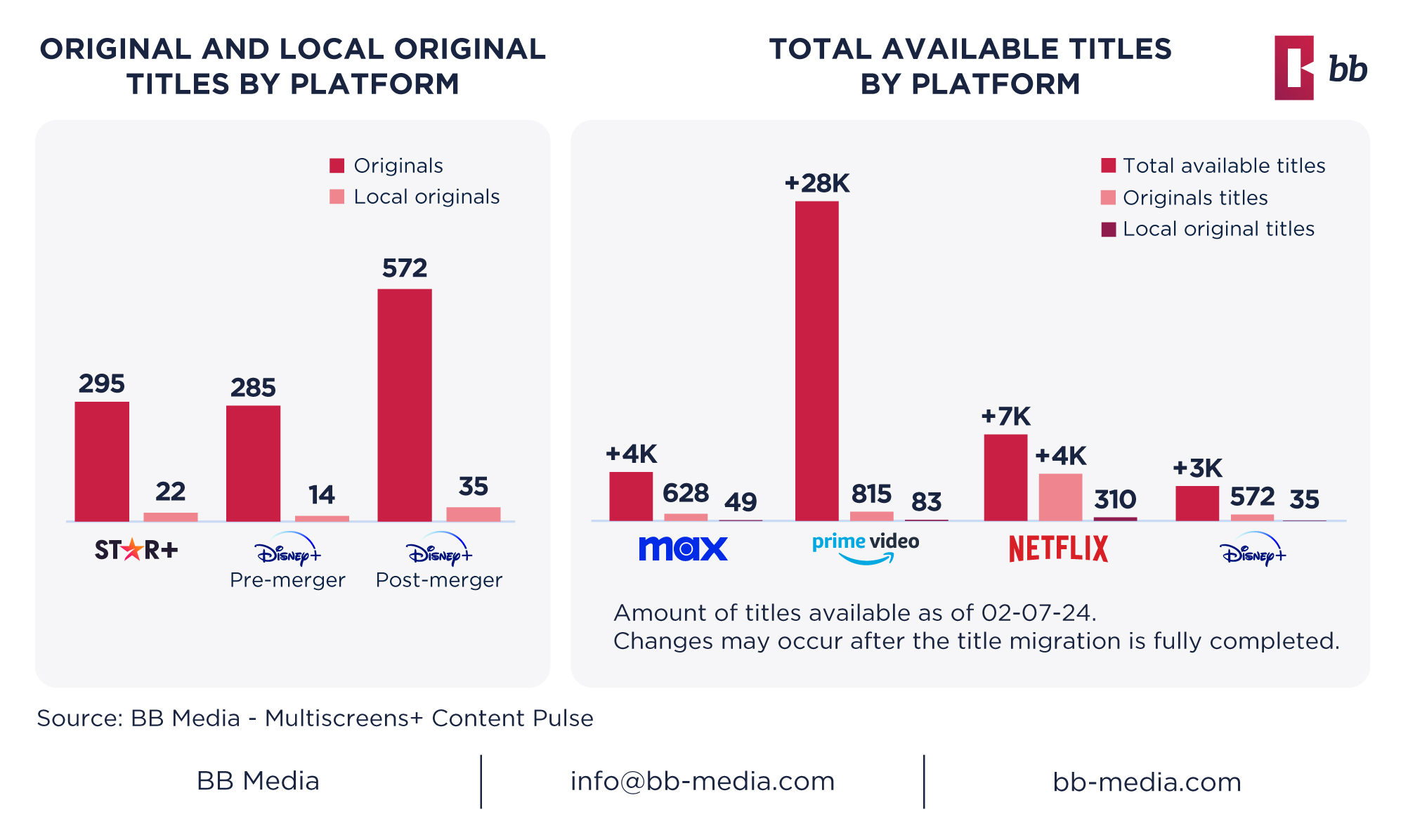

Of these titles, both Disney+ and Star+ had created and offered an extensive collection of original content, with Star+ leading. In general, Star+ held a greater emphasis on original series, accounting for 77% of the catalog. Conversely, only 39% of Disney+ originals were listed as series. Following the merger, Disney+ will provide users with a more extensive number of originals and further offer a greater balance of the different types of content. Specifically, the current catalog has duplicated its count of original titles from the previous Disney+.

When analyzing local originals, a greater disparity appears in the platforms’ former catalogs, in which Star+ previously contained nearly 44% more titles than Disney+. But how is Disney+ positioned after the merger with Star+ concerning the other main players in the region?

Following the merger, although Disney+ is still far from reaching the number of titles offered by well-established platforms in the region, such as Netflix and Prime Video, it has significantly closed the gap with Max’s content offerings. This narrowing is evident in both the total number of titles and the number of original and local productions currently offered by both platforms.

In general, Disney+ has a larger offering in UCAN, EMEA, and APAC than in LATAM. Compared to LATAM, the other three regions have between 800 and 1,500 more titles available in their catalogs. Disney+ has its most extensive offering, particularly in UCAN and APAC, where it currently offers 4,598 and 4,635 total titles respectively, compared to the 3,122 available in LATAM. This could indicate that Disney+ still has vast growth potential in the region, as it has not yet reached the number of titles it currently offers in other regions. The more comprehensive Disney+ catalog could potentially allow the platform to further expand within LATAM, offering a wider variety of content similar to what its competitors have been providing in the region.

In addition to expanding its content, Disney+ has innovated by adding live channels following the merger. Previously, sports events were dispersed or segmented by sport within Star+, but on the newly merged Disney+ platform, they are now included within the ESPN channels, making it easier for users to find. On the other hand, special events, such as concerts or award shows, will be available directly on the platform, outside of these channels. Users on the Standard Plan or the Standard with Ads Plan will have access to two ESPN live channels, while those on the Premium Plan will have access to four -except for Premium users in Brazil, who will have access to two extra live channels: ESPN 5 and ESPN 6-.

The entertainment industry is inherently dynamic; with new content constantly being created and distributed, new platforms are simultaneously being created and introduced to the public. This surplus of online subscription services can sometimes overwhelm users, leading to consumer fatigue and possible deterrence from a platform. The strategic decision by The Walt Disney Company to consolidate titles through the unification of these pre-existing services could help counteract this concern by introducing a larger, more inclusive catalog accessible through only one service.

Not only has the total number of titles greatly increased, by nearly 60%, and thus the catalog of Disney+; this consolidation brings upon a more vivid and diversified distribution of genres and content types. This transition is especially notable when we consider that Disney+, before the merger, emphasized its family-friendly content and features. Following the merger, the prominence of Family and Animation titles has been greatly reduced relative to other, more mature genres like Drama. This transition, paired with the addition of live sports streaming and the increase of original and local titles, reduces the need to focus on one target audience or demographic as the new platform likely appeals to people of all ages and interests.

The extensive amount of content and increased variety in content choices may also bring the platform closer to acquiring the same volume and diversity of titles as its top competitors. Consequently, this could enable Disney+ to continue expanding across the streaming market within LATAM.

BB Media | Multiscreens+ Content Pulse | Content Tracker | 2Q 2024

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.