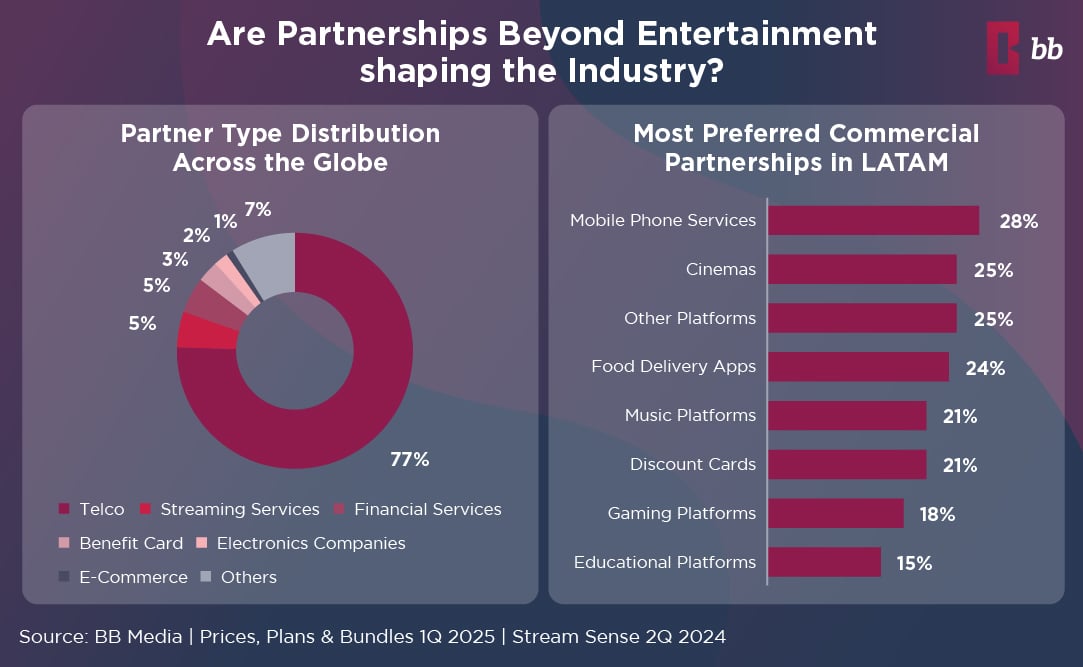

Are Partnerships Beyond Entertainment shaping the Industry?

In 2024, partnerships in streaming took on a new dimension as platforms diversified their strategies, collaborating with industries far beyond traditional entertainment. Telecommunications still held a dominant 77% share, but the focus expanded to positioning streaming platforms as integrated solutions for users’ daily lives.

Partnerships in Streaming Are Expanding Catalogs and Bundles

One of the most notable examples in 2024 was the partnership between Warner Bros. Discovery and The Walt Disney Company. In the United States, they launched a bundled package combining Disney+, Hulu and Max. This offering is priced at $29.99 for an ad-free subscription or $16.99 with ads—a 43% price reduction compared to standalone subscriptions.

Similarly, partnerships in streaming expanded globally as platforms like Apple TV+ and Lionsgate+ integrated their catalogs with Prime Video across European countries and New Zealand.

BB Media’s analysis reveals that households in the United States use an average of five streaming platforms, compared to four platforms in Europe and Asia. These collaborations not only enhance and diversify content libraries but also foster a more interconnected global streaming market.

New Players in Strategic Partnerships

In 2024, platforms increasingly partnered with companies outside the telecommunications sector to embed themselves into users’ daily routines. For instance, users who rely on services like Uber, Cabify, PedidosYA, or fintech apps are also key streaming audiences, opening up opportunities for cross-industry partnerships.

In Europe, retail collaborations became prominent. Netflix partnered with Carrefour in France, while in Spain, Dia joined forces with Disney+.

Other recent examples of innovative partnerships include Instacart’s collaboration with Peacock in the United States and BluTV’s partnership with Hepsiburada, an e-commerce platform in Turkey. In Latin America, Mercado Libre emerged as a major partner, bundling Disney+ in some subscription tiers and offering discounts on platforms like Max, Paramount+ and ViX. Additionally, Brazil’s digital bank Nubank partnered with Max to provide its Basic with Ads plan to select customers.

Similarly, in Latin America, 25% of users are interested in partnerships with movie theaters. This highlights an untapped avenue to bridge in-home and out–of-home entertainment experiences.

Growth of Commercial Bundles in Streaming Partnerships

The growth of commercial bundles—packages that combine streaming services with additional perks at lower prices—has also been a defining trend in 2024.

Commercial bundles grew by 6% last year, proving their effectiveness in attracting new users and retaining audiences. While UCAN saw the highest growth (+11%), Latin America leads in the number of active bundles, particularly in Mexico, with over 1,100 offerings.

Projections for 2025

Looking ahead, partnerships in streaming are expected to focus on service convergence. This includes collaborations between platforms and industries outside of entertainment. Platforms that successfully integrate into users’ daily lives will likely lead the market, reshaping the future of digital entertainment and setting new standards for user engagement.

Sources

BB Media | Stream Sense | Online Media Essentials | Prices, Plans & Bundles

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Our Latest Insights

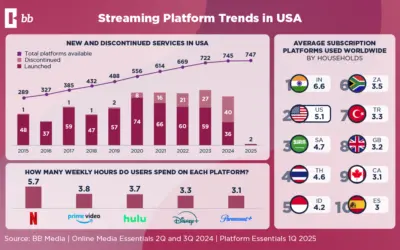

Streaming Platform Trends in 2024

The streaming industry is shifting towards consolidation, bundling, and ad-supported plans. Explore how platform closures and pricing strategies impact users.

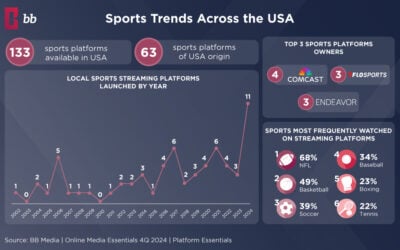

Sports Streaming Trends in the US

Sports streaming is taking over the digital landscape, with more dedicated platforms than any other genre. From free ad-supported models to exclusive Super Bowl experiences, discover how sports content is evolving.

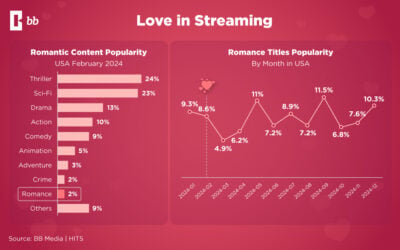

Romance Content Trends Revealed

BB Media’s latest analysis shows that romance content isn’t just a February affair. Explore year-round trends, shifting audience interests, and how platforms are integrating love stories into their content strategies.

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.