Saudi Arabia Streaming Trends: Local Titles Dominate the Market

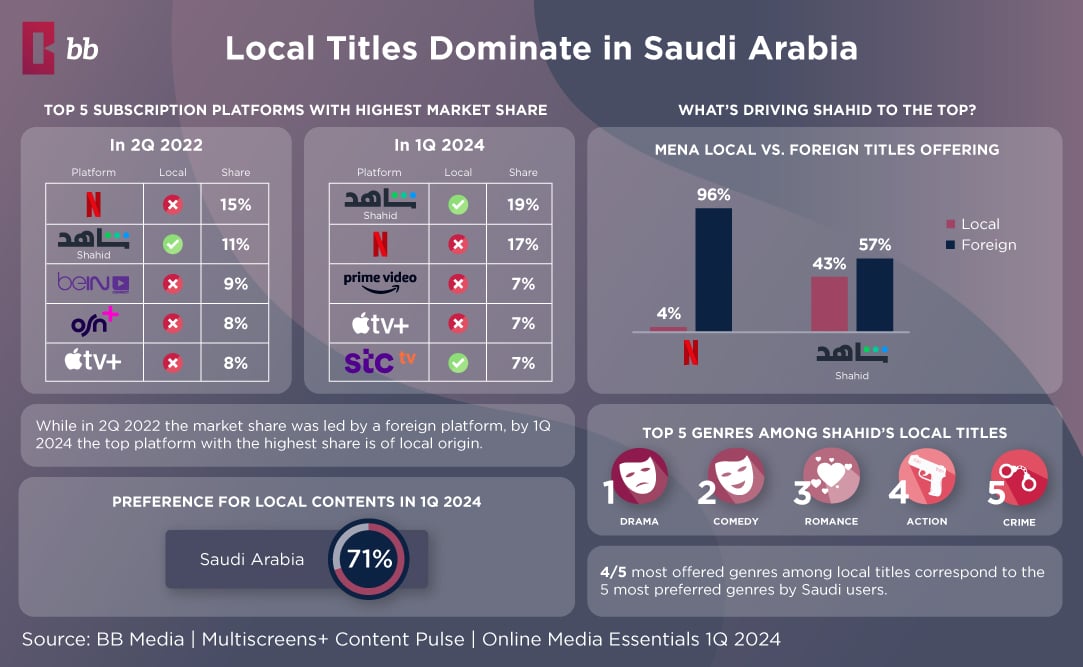

Impact of Local Preferences on Saudi Arabia’s Streaming PlatformsStreaming preferences in Saudi Arabia are shifting, and the streaming market is following closely behind. During the first quarter of 2024, 71% of online media consumers in Saudi Arabia reported watching locally produced content in the past three months. This shift in Saudi Arabia streaming trends is reshaping the market and affecting the distribution of market share across platforms.

Impact of Local Preferences on Saudi Arabia’s Streaming Platforms

This preference for local content has contributed to the transformation of Saudi Arabia’s leading platforms, influencing market share distribution within the streaming industry. Over the past two years, Saudi Arabia’s streaming trends have evolved as users turn to local providers and geographically relevant platforms. In 2Q 2022, foreign companies dominated, accounting for 4 out of the Top 5 platforms, with Netflix leading in market penetration. As of 1Q 2024, however, Shahid, a Saudi Arabia-based streaming service, has taken the top spot, followed by STC TV, another local platform.

Local vs. Foreign Content: A Key Factor in Saudi Arabia Streaming Trends

A deeper look at the offerings reveals that 96% of Netflix’s catalog consists of foreign content, while Shahid’s catalog contains almost half local content produced in Saudi Arabia or the MENA region. Only 4% of Netflix’s catalog in Saudi Arabia features Arabic-language titles, highlighting the challenge Netflix faces in catering to local preferences. Shahid’s growth shows the importance of tapping into these local trends.

In response to these shifts in Saudi Arabia streaming trends, Netflix announced earlier this year its plans to expand its Arabic slate. New seasons of fan-favorite shows such as Al Rawabi School for Girls, Finding Ola, Dubai Bling, and The Exchange are in the works, alongside new releases like Honeymoonish, Basma, Echoes of the Past, and Love Is Blind, Habibi—all set for 2024. This expansion reflects Netflix’s commitment to investing in content that resonates with audiences in the MENA region, aiming to stay competitive with local platforms like Shahid.

Local Content Dominates Saudi Arabia Streaming Trends

Local content is on top and growing in Saudi Arabia, driven by preferences for relatable stories and Arabic-language offerings. Whether it’s the desire for culturally reflective narratives or content in the official language, Saudi Arabia streaming trends highlight the importance of local productions. Global streaming giants should consider diversifying their catalogs with more locally relevant content to stay competitive in niche markets like Saudi Arabia.

Sources

BB Media | Multiscreens+ Content Pulse | Online Media Essentials

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.