UK Streaming Market

Discover the UK Streaming Trends, Business Models and Churn RatesDuring the first quarter of 2024, 84% of British households surveyed reported watching online content over the past three months. The UK streaming market continues to grow, with 2 points increase in the number of streaming service users from the previous quarter and 5% points from the second quarter of 2022. Streaming service adoption in the UK is expanding rapidly, with a decrease in ex-users from 9% to 6% over the past two years, showing strong streaming engagement.

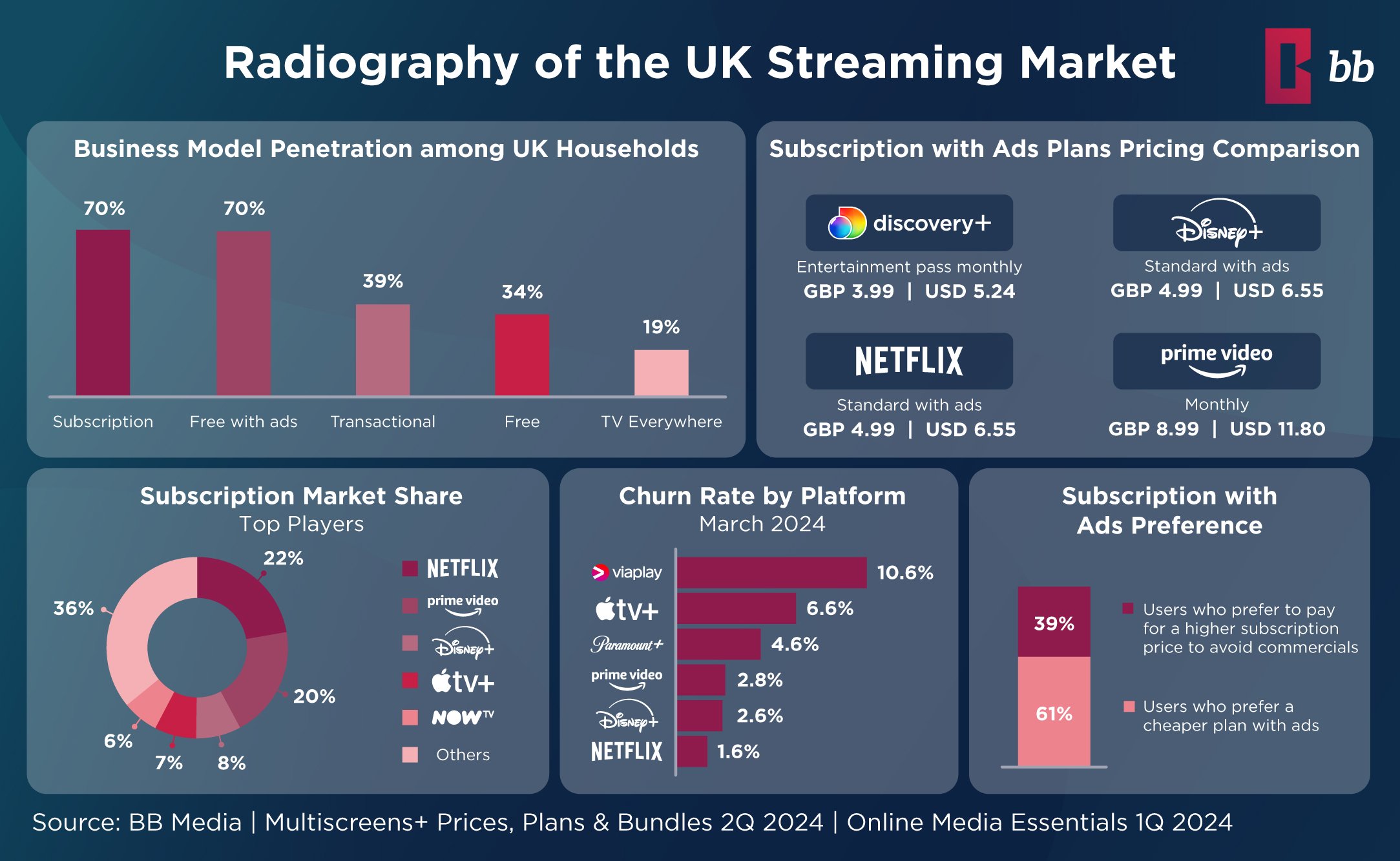

Business Models with Highest Penetration Rates

As of early 2024, both Subscription and Free with Ads streaming services dominate the UK streaming market, each boasting a 70% penetration rate. Subscription with Ads follows closely with a 61% preference among UK Subscription users. Netflix’s Subscription with Ads user base has grown significantly, reaching 19% in the first quarter of 2024, reflecting a steady 9% point rise since Q2 2023. Disney+ and Prime Video also offer Subscription with Ads plans. While Disney+ remains at 16%, Prime Video experiences higher ad plan adoption at 27% due to its particular business strategy, which includes ads in all its current subscription plans and offers an ad-free experience for an additional £2.99 per month.

Top Subscription Players and Churn Rates

Netflix and Prime Video lead the UK streaming market, capturing 22% and 20% market shares, respectively. Other notable players include Disney+ (8%), Apple TV+ (7%), and Now (6%). Despite its growth, Apple TV+ faces high churn rates at 6,6%, positioning it among the platforms with the highest churn both in the UK and globally. Paramount+ follows with a 4,6% churn rate. In contrast, Prime Video, Disney+, and Netflix maintain lower churn rates, at 2,8%, 2,6% and 1,6%, respectively.

Sources

BB Media | Multiscreens+ Prices, Plans and Bundles | Online Media Essentials

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.