What alliances are coming in Latin America?

An analysis on the strategic convenience of commercial agreementsThe streaming platforms Max (formerly known as HBO Max), Disney+, Amazon Prime Video, Netflix, and Paramount+ have established various strategic alliances with telecommunications, financial, and commercial companies in the Latin American region, to attract or retain subscribers. These commercial agreements tend to be linked to plans based on the Subscription VOD business model. However, BB Media identified that in Mexico and Brazil they began to negotiate agreements with Ad-supported Subscription VOD plans.

BB Media has found that 87% of the alliances established in LATAM are oriented towards telecommunications companies. This strategy allows them to expand the reach of the platforms and take advantage of existing infrastructure to offer more comprehensive solutions to end users. In addition, partnering with a telco allows for complementing access to streaming services with a wide range of innovations (such as 5G coverage, fiber optics, high-speed navigation, and integrating services such as mobile telephony, Internet, cable television, and fixed telephony) which simplifies the management of communication services by contracting them all through the same provider.

Moreover, 6% corresponds to Ecommerce companies (such as Mercado Libre), 3% to other streaming services, and the remaining percentage reaches financial services, electronic companies, entertainment services, and others.

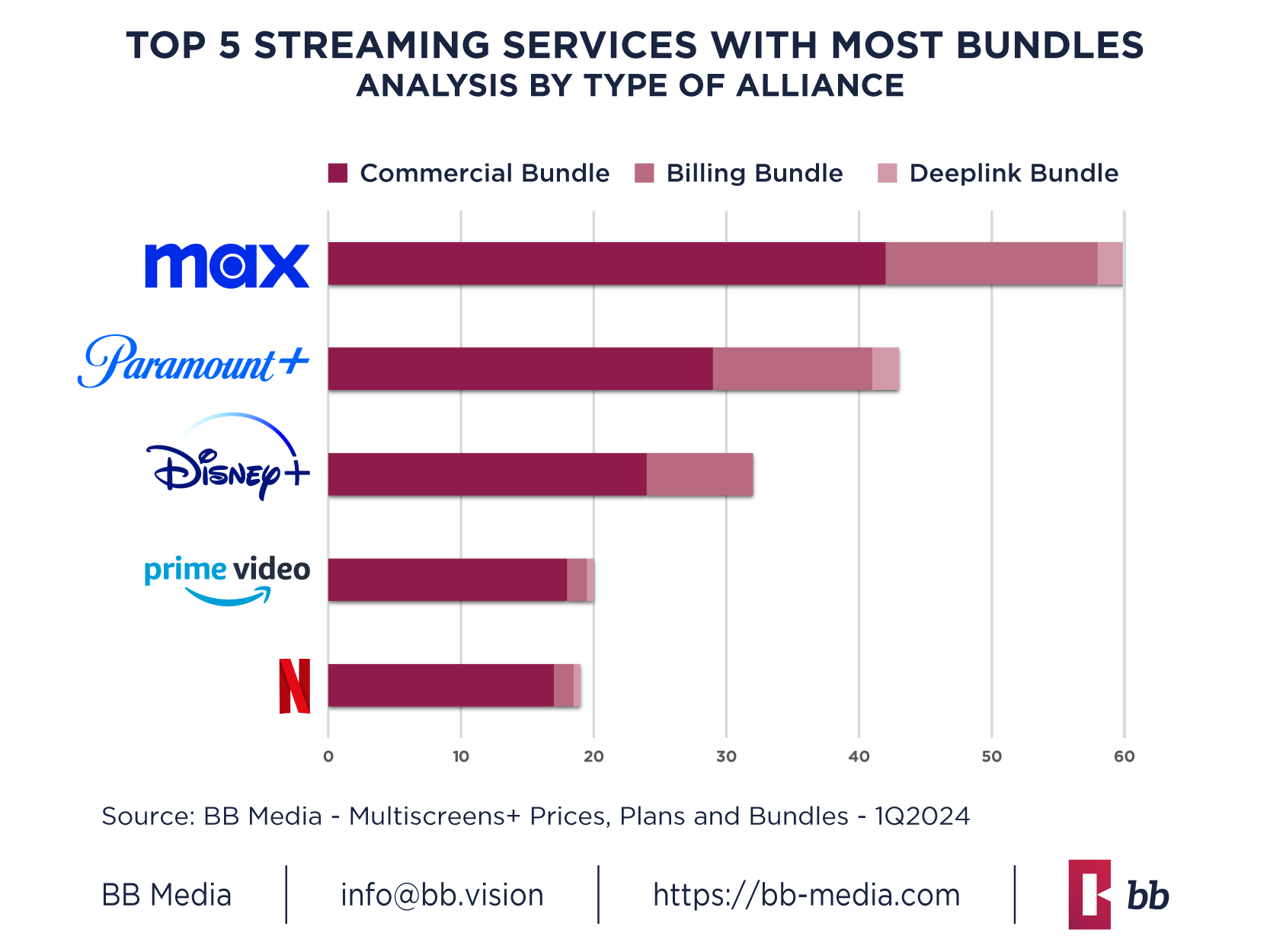

In addition, BB Media also identified that approximately 57% of the alliances are classified as billing bundle. That is, the cable operator or company acts as an intermediary and directly charges money for the streaming platform, but the user still pays for the service itself. To access the streaming services, the user must have a previous plan or service with the company.

On the other hand, around 38% are commercial bundles. In this model, access to the streaming platform is offered as part of a package that is included in the main offer of the service provider.

Finally, 5% of the alliances are of the deeplinks bundle type. In this modality, the company allows access to the streaming platform outside its main page. Within the operator’s website, the streaming service is displayed and, by clicking, the user is redirected to the streaming platform’s website.

RANKING OF streaming services WITH MORE PARTNERS

Max stands out for its extensive network of partnerships that offer free trials and discounts. In fact, it is the platform with the most extensive partnership network in the market, with around 60 alliances, including companies such as Rappi, Directv/DGO, and Movistar. These partnerships usually offer free trials of 60 days with select partners, in addition to percentage discount offers.

Paramount+ has been expanding its network of alliances in the last year, with companies such as Alares, Claro, and Mercado Libre. Thanks to its strategy, it managed more than 40 collaborations. In addition, much of its content is available on Claro Video, Claro’s streaming platform, as well as on Flow. Although it is not considered an alliance corresponding to any of our previous classifications, this content integration reflects an effective partnership that extends the reach and accessibility of Paramount+ content through different platforms and services, to benefit end users.

Although Disney+ has more than 30 alliances, the collaboration with VISA in several countries in the region since 2021 stands out, offering free subscription periods according to the type of card. In addition, the integration of Disney+ into telecommunications packages along with Star+ adds value for subscribers by offering Combo+ at no additional cost. It is relevant to highlight that Disney+ does not offer free trials or offers independently (except once a year, when they make a unique offer for Disney Day), but access to these promotions is only possible through strategic alliances. The direct inclusion of Combo+ in telecommunications packages provides convenience and savings for users. One of Mercado Libre’s most outstanding offers is the subscription to Level 6, which includes both streaming services for free and facilitates subscription growth.

Amazon Prime Video has established approximately 20 alliances, which usually include free trials that vary in duration, between 30, 60, or 90 days, depending on the partner. This strategy allows users to try the service for a longer period than the platform allows, whose included free trial extends only from 7 to 30 days.

Finally, although Netflix is the most famous platform and has the largest number of subscribers in Latin America, it has around 19 alliances. Netflix does not have its own offers and most collaborations are limited to offering the possibility of billing the streaming platform along with the partner’s services. Several months ago, Netflix introduced its advertising plans in Mexico and Brazil, which led to the formation of prominent strategic alliances in both countries. In Mexico, this option is already available in packages offered by three telecommunications companies: Megacable, Telnor, and Telmex. In Brazil, at the beginning of 2024, the companies Claro and Globoplay began offering the Netflix plan with ads.

What can we expect for this year?

As the streaming market continues to evolve, we are likely to see not only greater expansion but also diversification in partnerships between streaming platforms and companies from different sectors. These alliances could include travel companies, other delivery services, technology companies, and more, with the aim of offering comprehensive experiences to users.

Considering the recent introduction of advertising plans and the new alliances that are emerging in Brazil and Mexico with these plans, it is noteworthy that both Netflix and Max already have subscription options with ads in the region. Although Prime Video, Disney+, and Paramount+ offer this type of subscription globally, they are not yet available in Latin America, although they are expected to be added in the coming months. This landscape suggests that during 2024 we will see a significant increase in alliances with the Ad-supported Subscription VOD business model in the region, as these plans are usually more economically accessible for users.

Recently, BB Media has also detected that many companies that had alliances with the main streaming services launched their own platforms. Two examples of this were Mercado Libre with Mercado Play and Claro with Claro Video. This suggests that their commercial agreements with other platforms could decrease to focus on offering their own content or even directly integrating their content into their own platforms, instead of acting as intermediaries between users and streaming services.

In this way, users may be attracted to consume the content offered by these companies that they may have contracted for access to the streaming platforms with which they had previously formed alliances. Everything indicates that during 2024 the streaming services landscape will continue to adapt to become even more competitive and that users will find several alternatives to choose from.

Sources

BB Media | Spending Tracker | 4Q 2023

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.