South Africa Trends: Local Platforms Lead the Market

Exclusive Report for MIP AfricaLocal Platforms Dominate South Africa’s Streaming Market

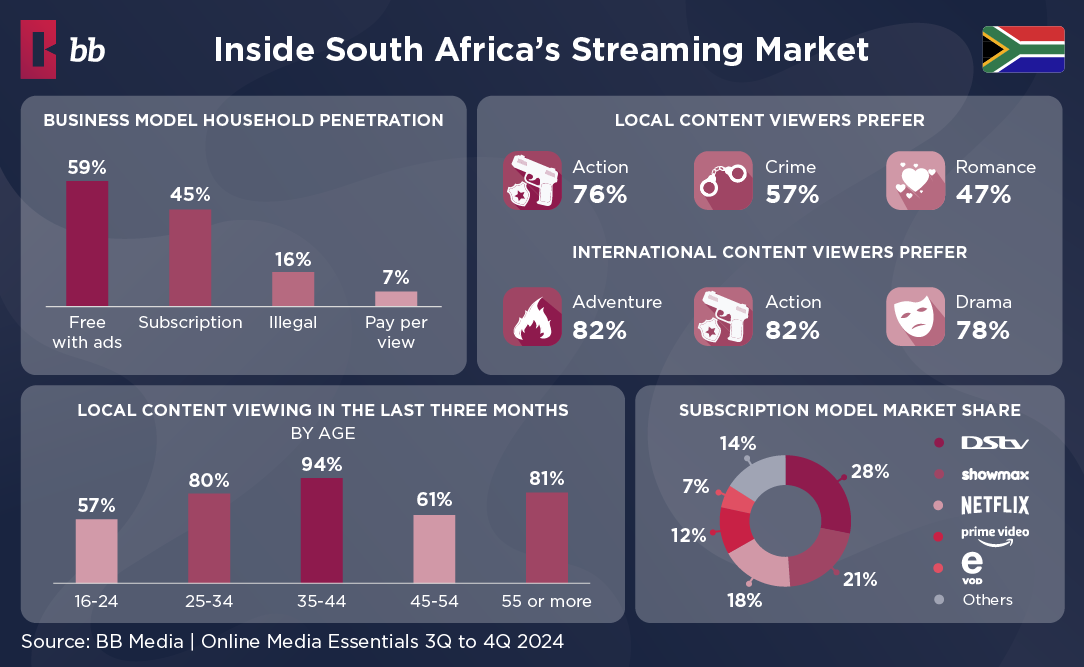

In a world where global streaming giants dominate, South Africa streaming trends reveal a strong preference for local platforms. Within subscription streaming services, DStv streaming service leads with a net penetration of 16% as of Q3 2024. Showmax trails with 11%, while Netflix follows closely at 10%.

BB Media tracks 510 streaming platforms available in South Africa, yet only 7 are local: DStv, Showmax, SABC+, eVOD, Todazon, AfriDocs and Freevision Play. Despite being few, they cater to a significant portion of South African audiences. Most of these platforms offer a free or free with ads option and one (SABC+) is government owned.

South Africans Prefer Local Content

South African audiences strongly favor homegrown entertainment. Among those who have watched online content in the past three months, 76% said they had streamed local content during that period.

Among viewers who consume local content, Action ranks as the top genre (76%), followed by Crime (57%) and Romance (47%). Meanwhile, those who haven’t watched local content recently prefer Adventure (82%), Action (82%) and Drama (78%).

Meanwhile, for U.S. content, Documentaries lead with 14%. When considering all available content in the country, Drama stands out as the dominant genre, accounting for 23% of titles.

Free with Ads Grows in Popularity

The free with ads revenue model hold the largest penetration in South Africa (59%), while subscription services lag with 45%. However, only 15% of platforms operate under the free with ads model, compared to 40% using a traditional subscription approach. As so often happens in the industry, some platforms offer more than one business model, but BB Media took it into consideration for the analysis.

Subscription with Ads remains the least common model, representing just 2% of available platforms. However, consumer interest is evident—76% of households stated they would opt for a more affordable plan with ads to cut costs.

The Influence of Illegal Streaming

Piracy continues to be a challenge in South Africa’s streaming landscape. Illegal platforms hold a 13% market share, with Goojara leading at 12% penetration. Many consumers turn to these services due to financial constraints. This highlights a significant opportunity for platforms to expand ad-supported offerings and attract cost-conscious viewers.

Among former Netflix subscribers, cost concerns are a major factor. When asked why they canceled, 40% cited financial difficulties, while 27% said the platform was simply too expensive. This also explains the success of competitors like Showmax, which as of the last month of 2024 only cost USD 4,83 on average, compared to Netflix’s USD 6,75 price point.

What’s Next for South African Streaming?

As local platforms continue to dominate, South Africa’s streaming trends highlight a strong demand for regional content. The rise of Free with Ads services also indicates shifting consumer priorities, with affordability driving preferences. With piracy still a challenge, understanding user behavior is key to shaping the future of the industry.

ABOUT BB MEDIA

BB Media is a global Data Science company, specialising in Media and Entertainment for over 37 years. BB Media monitors more than 4,500 streaming services across 250 countries and territories, including their prices, plans, bundles, and commercial offers. In addition, it monitors all movie and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content apps, and tech companies rely on BB Media’s valuable information and analysis to make strategic decisions.

BB Media is part of Fabric.

ABOUT FABRIC

Fabric is the entertainment industry’s leader in data and operations solutions, empowering broadcasters, studios, distributors, producers, and media organizations to connect people with the content they love. Fabric’s platform combines the best of metadata and supply chain management with powerful media resource and workflow solutions, enabling customers to manage identification, editorial, technical, discovery, and AI-generated metadata with ease. By integrating cutting-edge technology with decades of industry expertise, Fabric streamlines operations, enhances decision-making, and drives efficiency across the entire media supply chain.

Our Latest Insights

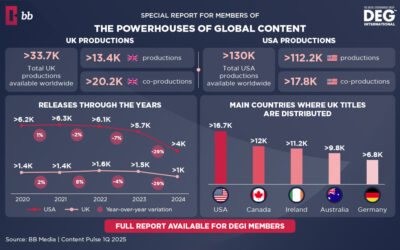

BB Media’s Streaming Industry Report for DEG Members

BB Media proudly presents its latest Streaming Industry Report, exclusively shared by DEG. This analysis offers key insights into the media landscape. It covers dominant players, content strategies, and revenue models. The report also explores the rise of original...

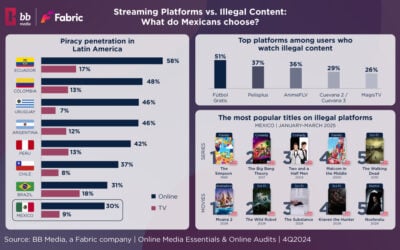

Streaming vs. Piracy in Mexico

While Mexico has the lowest online piracy rate in Latin America, one-third of households still access illegal content. Explore how streaming services, pricing, and user habits influence piracy trends in the country.

Key UK Entertainment Insights

In a significant development for the UK entertainment industry, DEGI: The Digital Entertainment Group International, in collaboration with BB Media, has released an exclusive report offering in-depth UK entertainment insights. This analysis sheds light on streaming...

Do you want to know more about what we do?

Do you want to know more about what we do?

Gain insights into content demand, empowering smarter decisions and maximising your media strategy's success.